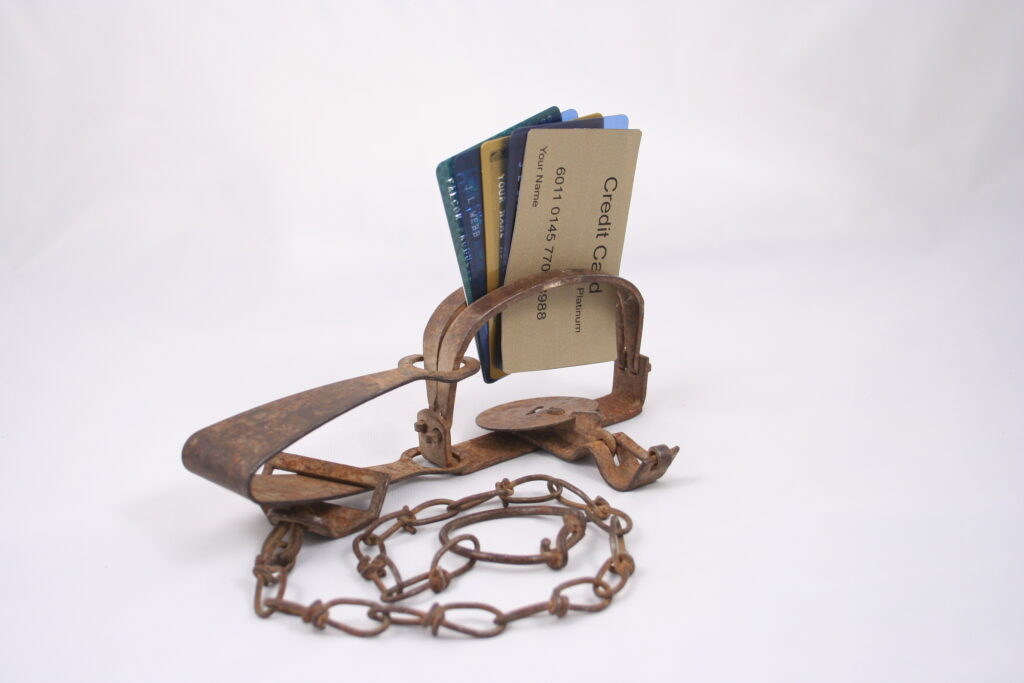

If you are stuck in a cycle of high-interest debt, it could be time to consider filing for a Chapter 7 bankruptcy.

Colorado Springs bankruptcy attorneys know that it becomes a vicious cycle: You have poor credit, so they give you a high interest rate, and then you’re stuck barely being able to make the minimum, so you’re scraping by just so you can cover the interest. At that rate, it could be a very long time before you are free from debt.

For example, let’s say you owe $20,000 and your interest rate is 17 percent. At that rate, you could pay $400 every month, and it would still take you 7 years to pay off – assuming you put no additional charges on that card. In that 7 years, you will have paid $15,000 in interest. Now, let’s say you can get that interest rate lowered to 10 percent. At that rate, still continuing to make that $400-a-month payment, you can pay off that debt in five years, and pay about $6,000 in interest.

As you can see, interest rates make a huge difference.

Of course, that’s not what the banks want, so they are likely to play hard ball when it comes to negotiating. And at the end of the day, if you’re borrowing money because you’re spending more than you make, then getting a lower interest rate is not going to be a long-term solution.

Factor in a major life change, such as a lay-off or illness, and the situation quickly begin to snowball.

This is where a Chapter 7 bankruptcy can help.

If will allow you to leave those debts behind – and not look back.

In moving forward, however, as you try to rebuild your credit, you are likely to be offered only credit lines that have exorbitant interest rates. The key at the very beginning is to taking out only the credit that you can afford to pay back in a short period of time. Doing this regularly over time will allow you to ultimately boost your credit score after bankruptcy.

What you want to keep in mind is that all this money you are forking over in interest to these banks is making it more difficult for you to retire on time, send your kids to college, start your own business – or whatever other goals you have.

A bankruptcy can change that.